Currency Intervention Strategies and Their Effectiveness

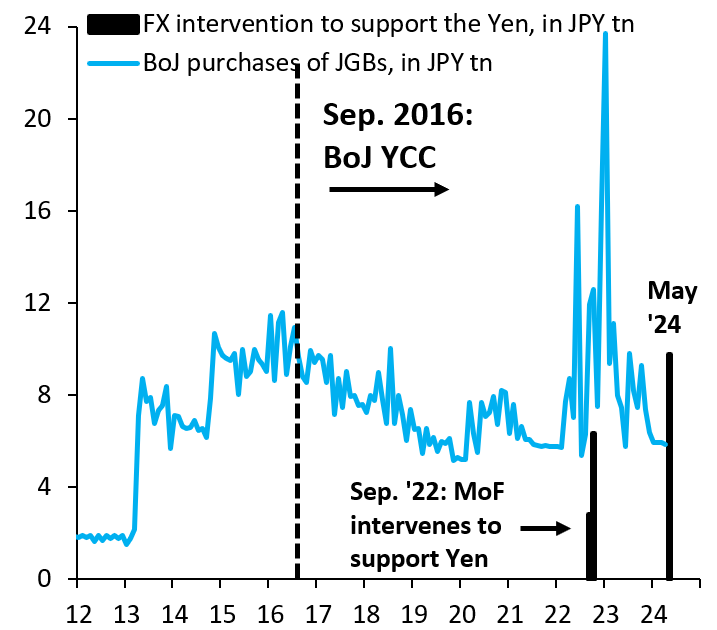

The Japanese government and Bank of Japan have employed various intervention strategies to address excessive yen volatility. These interventions typically occur when rapid currency movements threaten economic stability or when the yen's weakness begins to significantly impact import costs and inflation expectations.

Historical data reveals that intervention effectiveness varies significantly depending on market conditions, coordination with other central banks, and the scale of intervention relative to daily trading volumes. Verbal interventions, where officials express concern about currency movements without actual market operations, have shown mixed results in influencing trader behavior and market sentiment.

The timing and communication strategy surrounding interventions play crucial roles in their success. Markets closely monitor official statements and economic data releases for signals about potential intervention thresholds, creating a complex dynamic between policymakers and currency traders.